What is a megaphone pattern?

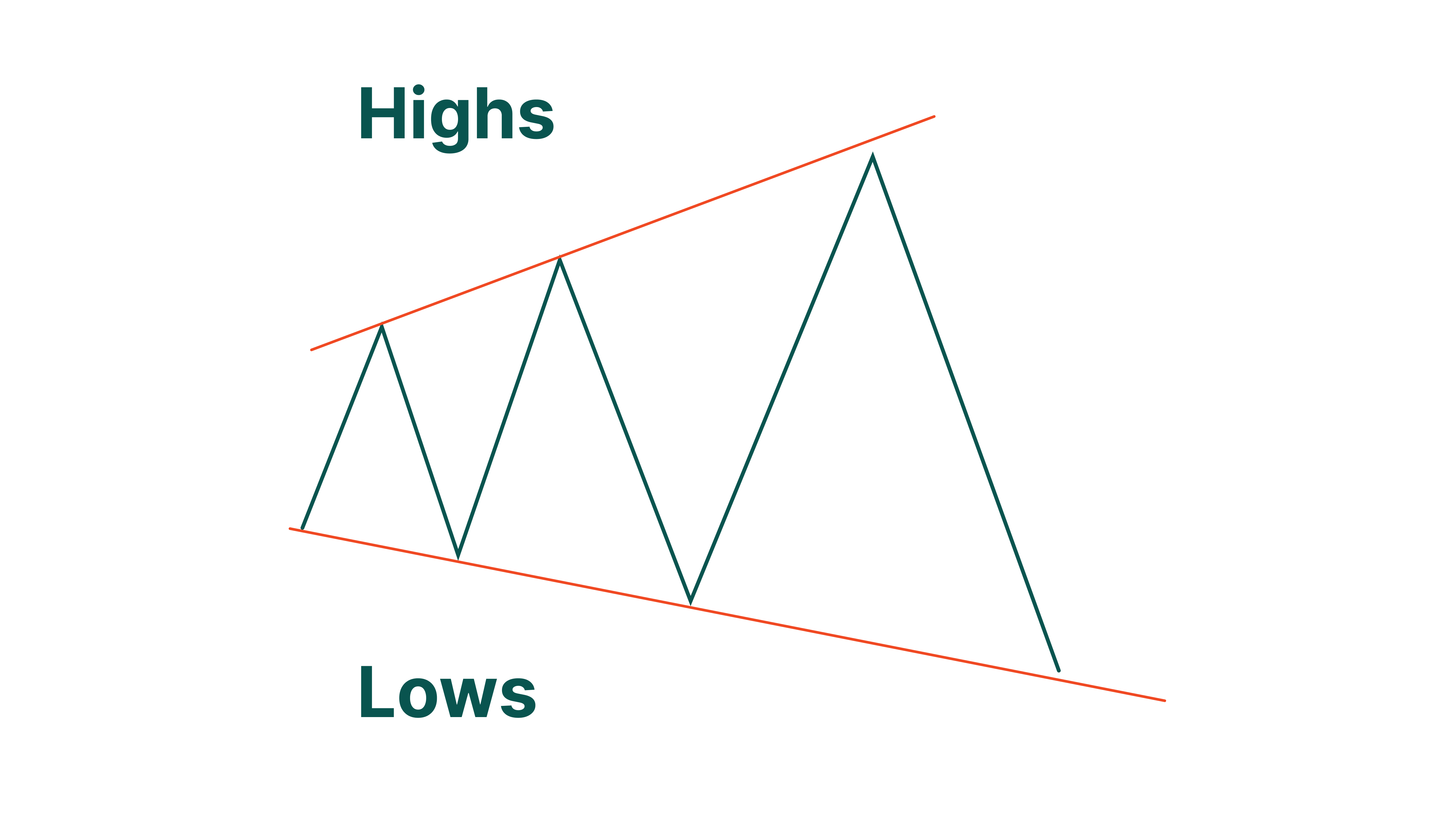

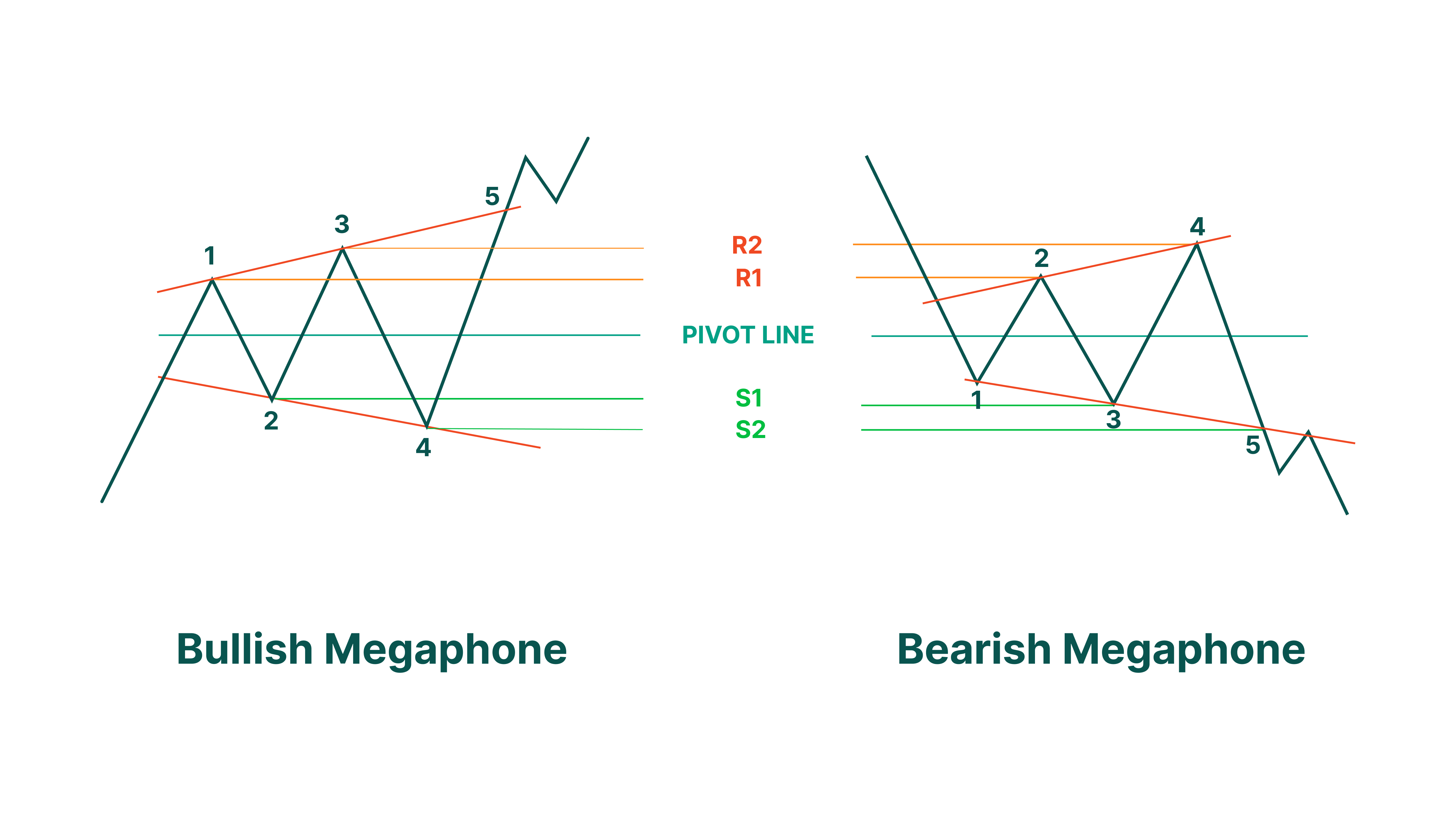

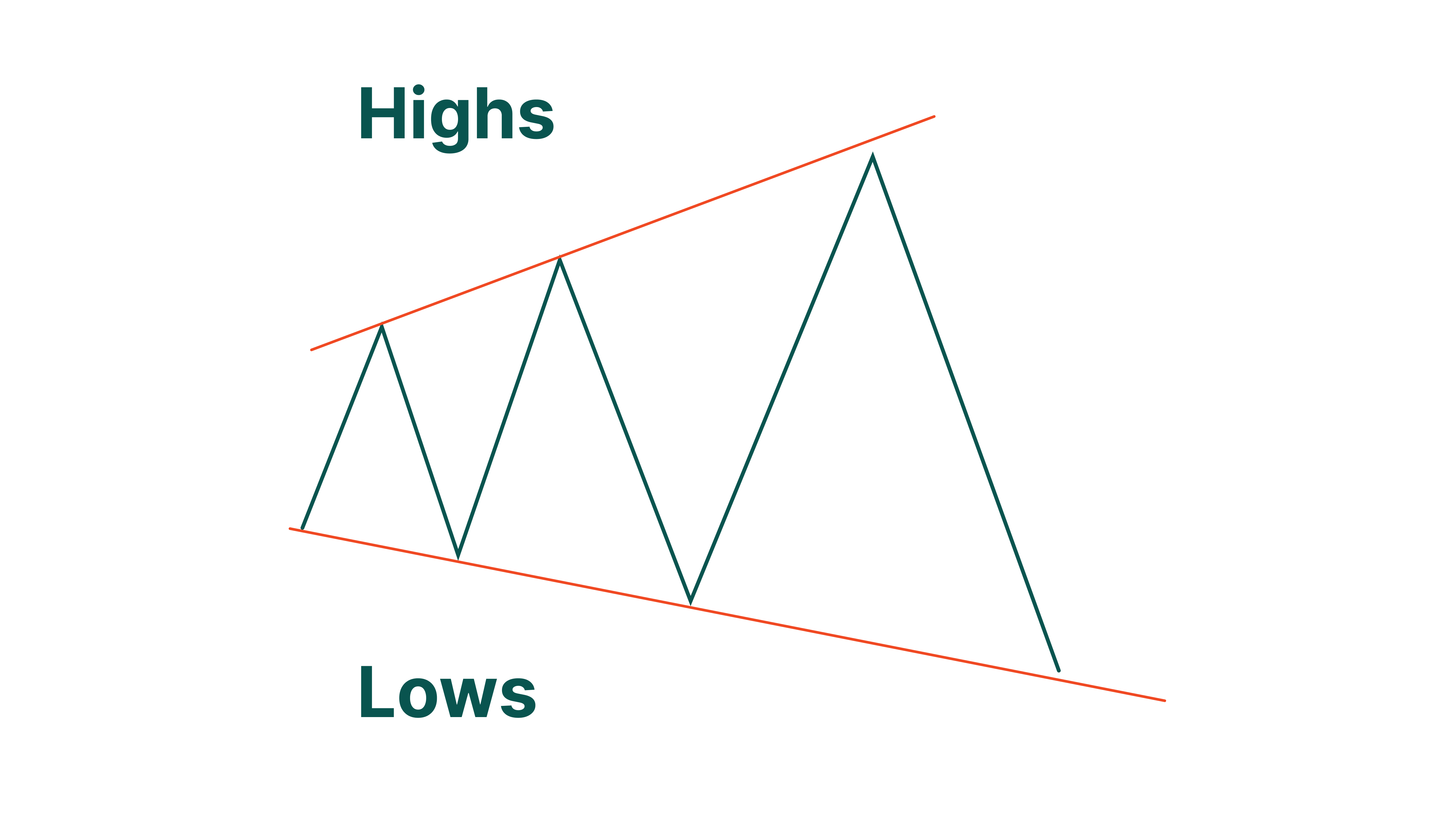

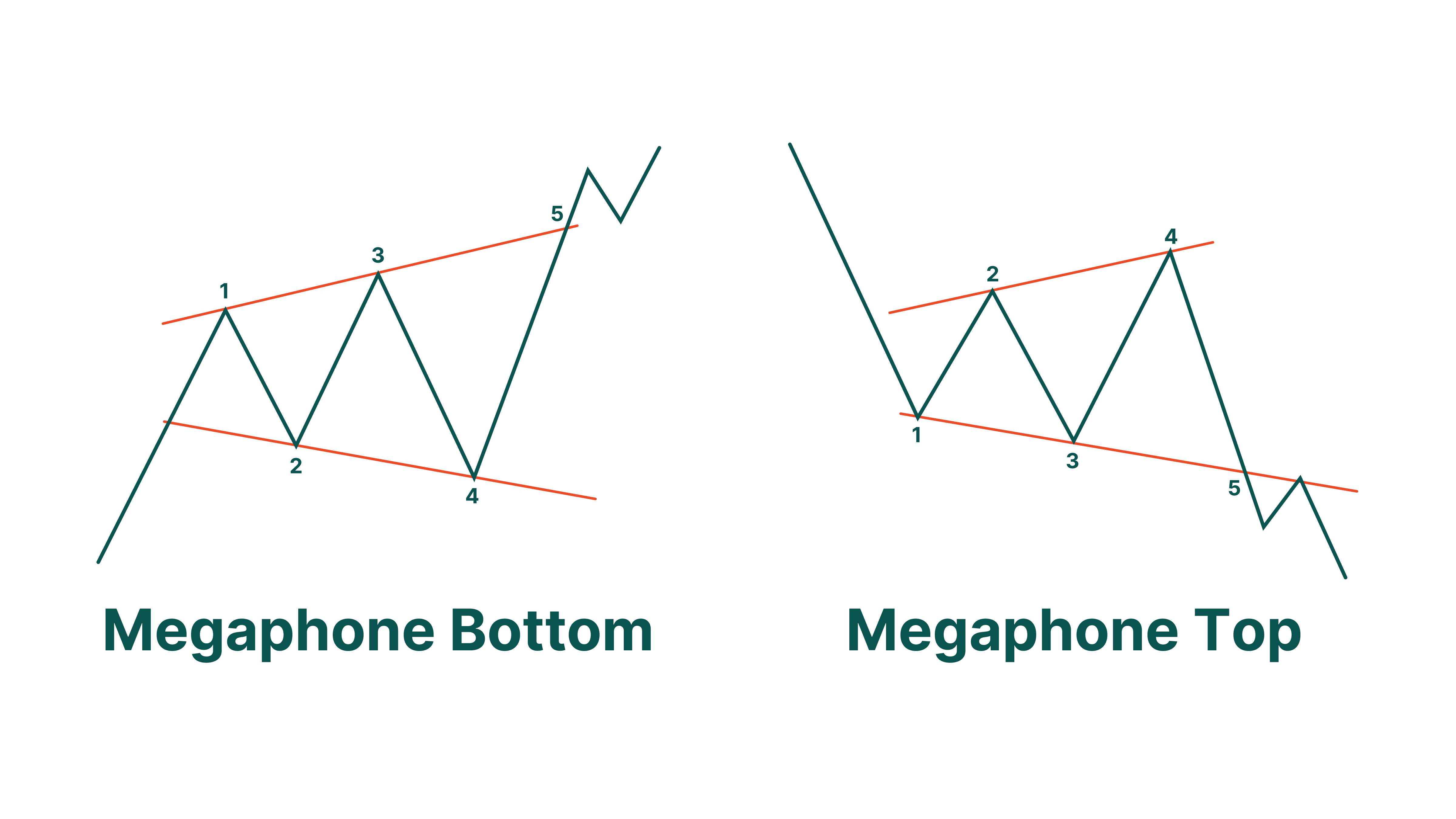

A megaphone pattern is a chart pattern that occurs when the price movement becomes volatile. It consists of at least two higher highs and two lower lows formed from five different swings. Each swing is larger than the previous one, and the higher highs and lower lows can be connected by two diverging trendlines that resemble the shape of a megaphone and give the pattern its name.

You can usually see this pattern at the top or the bottom of a market. It shows that traders aren’t confident about the market direction and try to enter or exit trades at the soonest opportunity, causing larger swings to form.

In this article you’ll learn about the ways to identify a megaphone pattern, whether a megaphone pattern is bullish or bearish, the main characteristics of this pattern, and how to trade the megaphone pattern when you spot it on a chart.

Key Takeaways:

- Megaphone patterns occur in volatile markets when bulls and bears are fighting to control the market.

- A megaphone pattern consists of five swings that form at least two higher highs and two lower lows. If trendlines drawn through the higher highs and lower lows diverge, then the pattern in question is a megaphone.

- Megaphone patterns can be bullish or bearish, but it’s impossible to tell for sure what pattern it is until the price closes outside the pattern and confirms the start of a new trend or a continuation of the previous one.

- Traders can use megaphone patterns in different trading strategies, depending on their preferred trading style and whether or not the pattern fails.

How to identify a megaphone pattern?

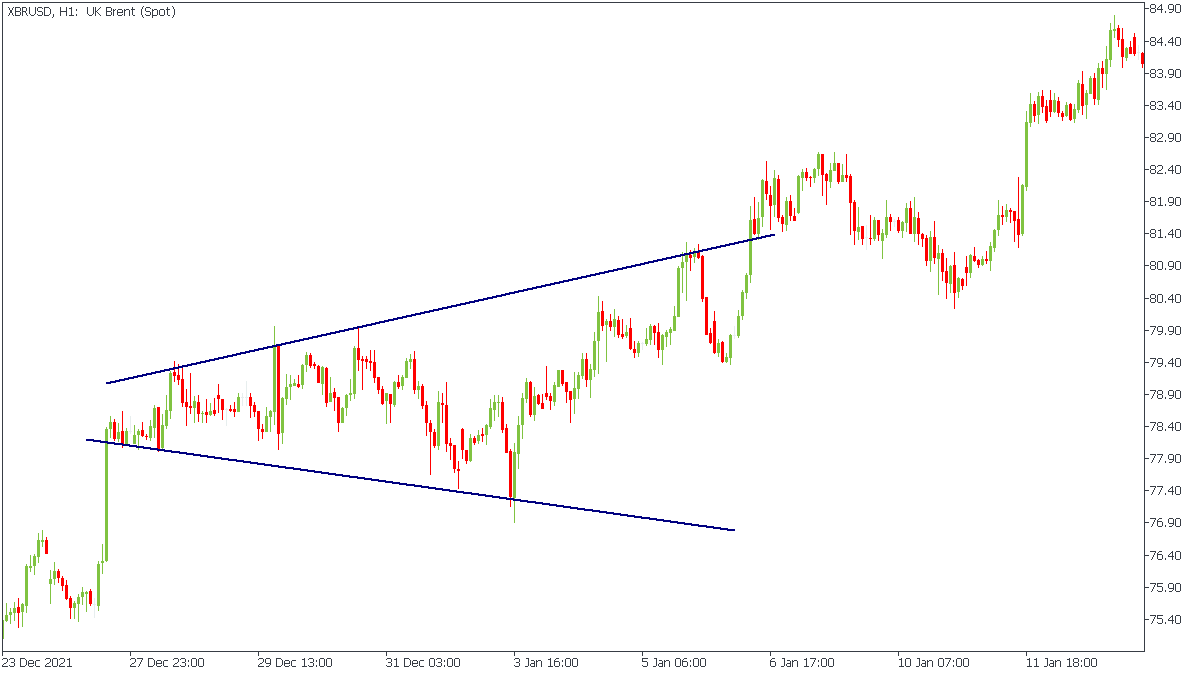

As was already mentioned, a megaphone pattern consists of five swings that form higher highs and lower lows. If you see a price moving in similar swings within an increasingly widening range, you can check if it’s really a megaphone chart pattern by drawing two trendlines: one through the higher highs and one through the lower lows. If the trendlines diverge in the opposite directions, then you’re definitely dealing with a megaphone pattern.

Another thing you should know is when and why a megaphone pattern can appear on a chart. Megaphone patterns occur when a market is going through a period of volatility. It doesn’t indicate a particular price trend. Rather, it tells us that traders can’t seem to agree on the price of the asset. They give in to their emotions and start buying when the price seems low to them and selling when it seems high. These swings stop the price from following a particular trend, which causes more indecision between traders.

Naturally, even such periods of volatility come to an end, so there are good strategies that allow level-headed traders to use a megaphone pattern to their advantage. The most important thing for them to do is to keep calm and not let the panic dictate their decisions.

Is a megaphone pattern bullish or bearish?

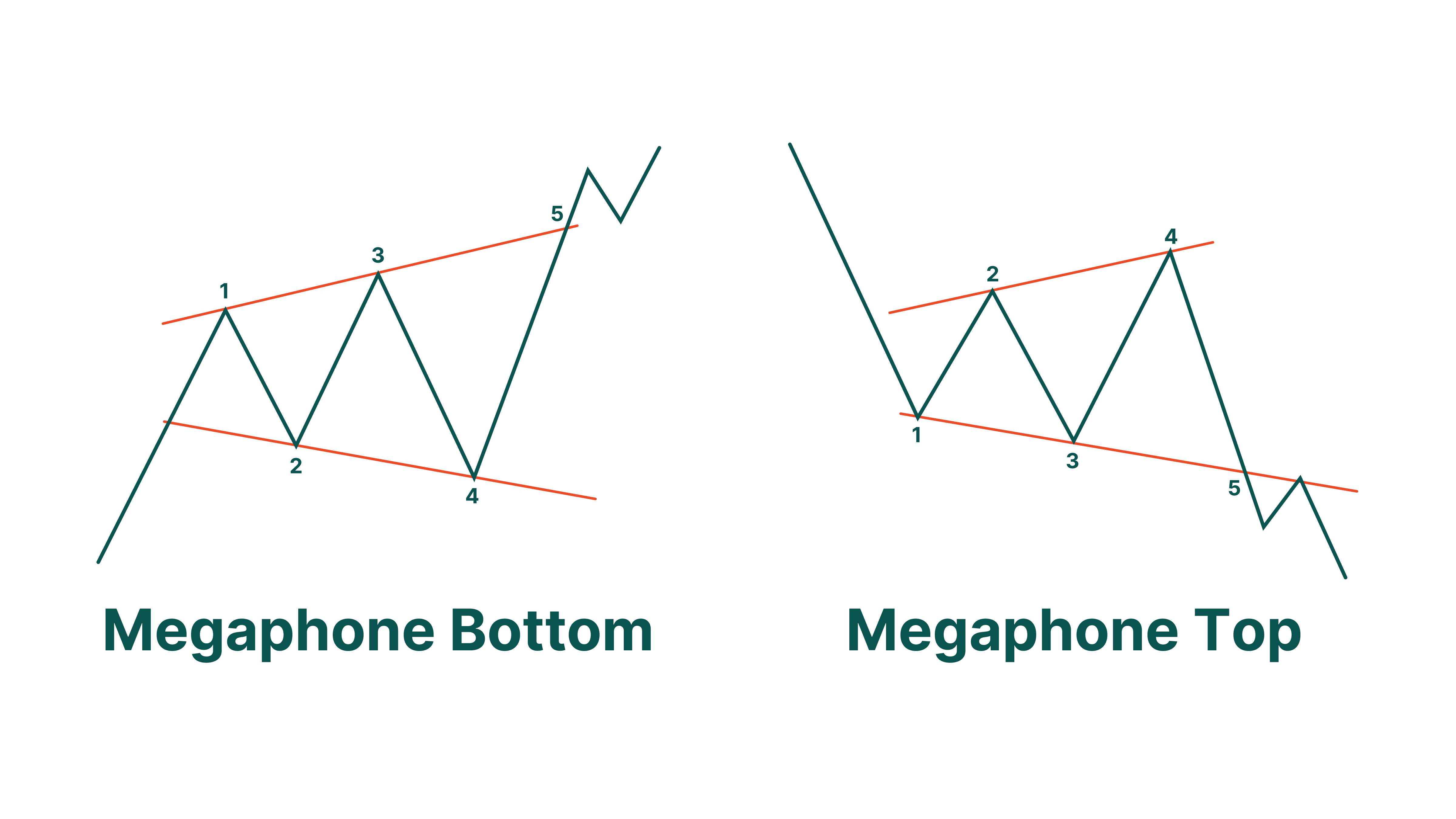

A megaphone pattern can be both bullish and bearish, depending on where on the chart it has formed. That’s why megaphone patterns are commonly divided into a megaphone top and a megaphone bottom.

- A megaphone top is a bearish megaphone pattern that indicates a possible reversal from an uptrend to a downtrend or a continuation of a downtrend. Generally, a megaphone top consists of three higher highs and two lower lows. The pattern is considered complete when the price breaks the trendline drawn through the troughs of the pattern. If this happens, there is a very high possibility that the market will start moving in a new downward trend.

- A megaphone bottom is considered less common than its bearish counterpart. In contrast to a megaphone top, a megaphone bottom is a bullish megaphone pattern that occurs before a potential reversal from a downtrend to an uptrend or indicates a continuation of an uptrend. This pattern tends to include three lower lows and two higher highs. After the third low the price usually moves in an upswing and breaks the trendline drawn through the highs, signaling the completion of the pattern and the beginning of a new uptrend.

However, it is impossible to say whether these megaphone patterns precede the reversal or continuation of a trend.

To find out the direction of the future trend for certain, it’s better to wait until the price breaks through the support or resistance line and the pattern is confirmed. Only then is it safe to enter a trade.

What is a broadening formation?

A broadening formation is another name for what we now know as a megaphone pattern. Broadening formations can be bullish (broadening bottom) or bearish (broadening top) and they generally indicate a potential trend reversal.

But if we look at the bigger picture, broadening formations are most famous for being volatility indicators. They start to form when a market is experiencing a period of higher risk. It happens because traders are unsure of where the price may move next, and so it’s fluctuating between rising and falling.

Broadening formations also occur more during earnings season when companies start reporting their quarterly earnings. Depending on whether a company has had success or not, traders will have different optimistic or pessimistic reactions, which affects price movement and can lead to the formation of a megaphone pattern.

Characteristics of a megaphone trading pattern

Since we now know what a megaphone pattern is, let’s study its main parameters in more detail.

Volume

The first parameter of a megaphone pattern you should pay attention to is volume. As you may know, volume is a technical indicator that represents the total amount of an asset that was traded during a certain period of time. Volume shows how much traders are active on the market and whether or not the asset in question is currently in demand. Volume is also used by traders to confirm the continuation or the reversal of a trend. So as you see, volume may give you quite a lot of information about the current situation on the market.

When it comes to volume, it helps traders to recognize a megaphone pattern on a chart. Traders may see that volume spikes along with the price within the megaphone pattern. You may also notice that volume generally increases and remains high when the pattern is formed.

However, volume doesn’t indicate potential reversal or continuation of the previous trend as it doesn’t appear out of the ordinary when one of them happens.

Underlying behavior

The next thing we’ll look into is the underlying behavior. As we learned, a megaphone pattern occurs when traders are trying to get control of the asset. The bulls keep buying and driving the price of the asset higher while the bears, on the contrary, try to counteract this development and sell the asset while the price is high, driving it lower and lower. The price swings keep forming new highs and lows, and if you draw two trendlines through these points, you will notice that the lines diverge in different directions. As a rule, this uncertainty and rising tension usually ends with one party abstaining from further action and the other party dominating the market. The pattern ends with the trend moving in the direction of the winning party, either continuing or reversing the previous trend.

How to trade megaphone patterns

Despite their inconclusive nature, megaphone patterns provide many trading opportunities. Megaphone traders can be incorporated into multiple strategies, depending on a trader’s trading style.

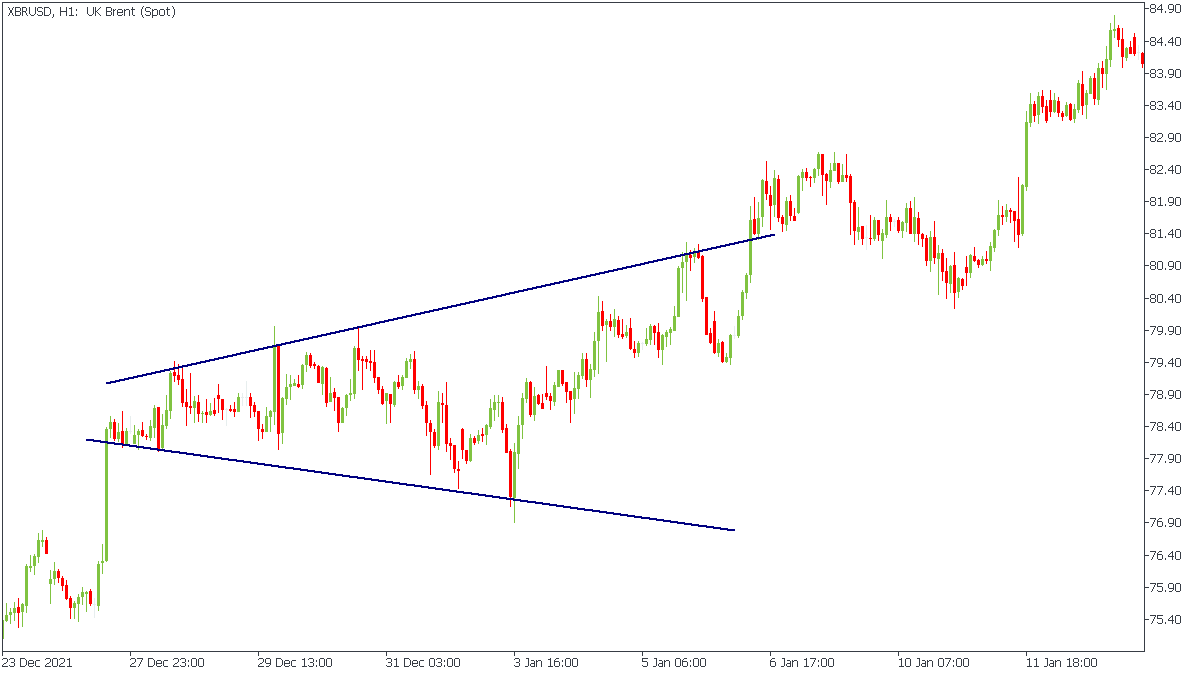

Breakout trades

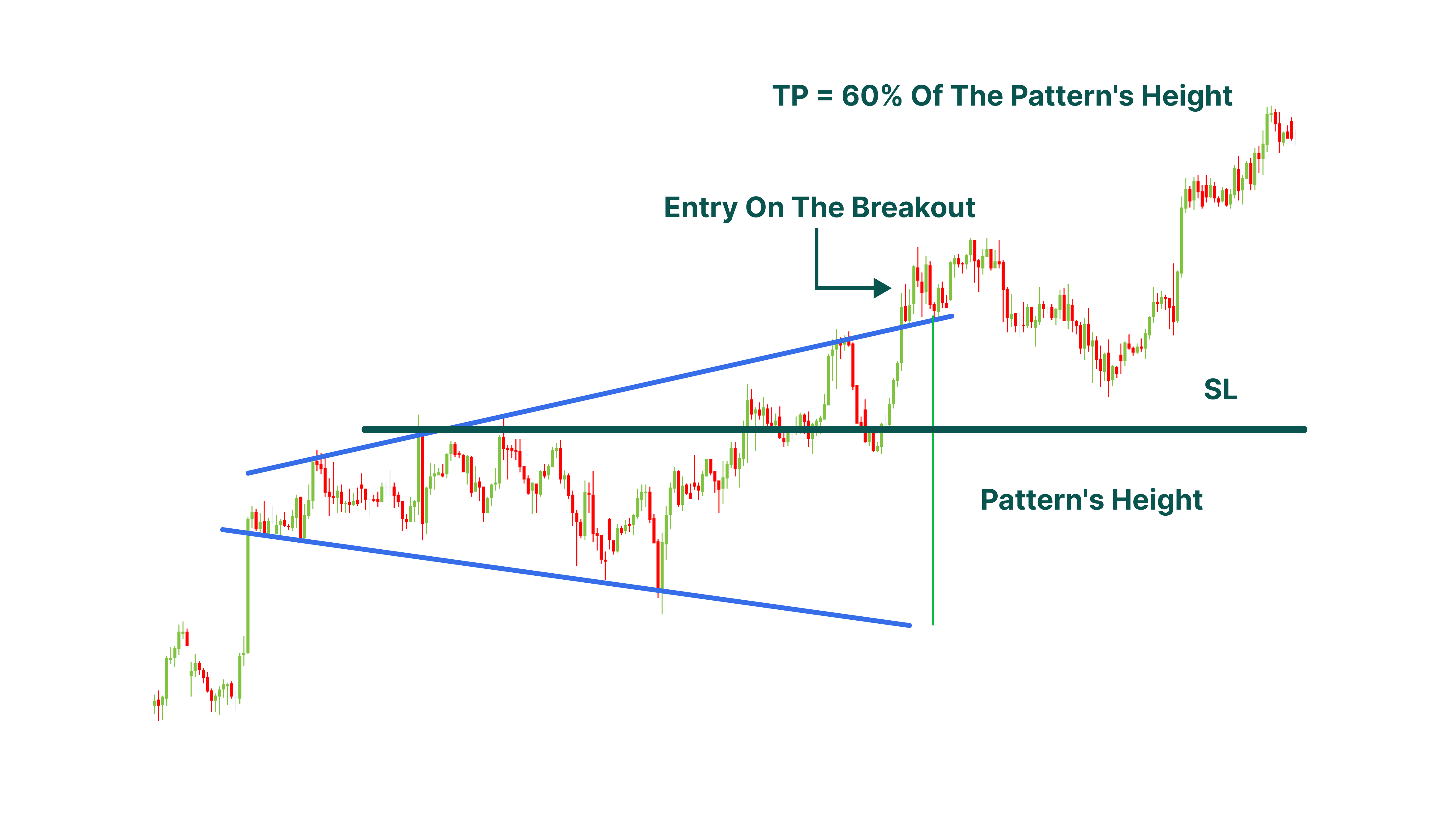

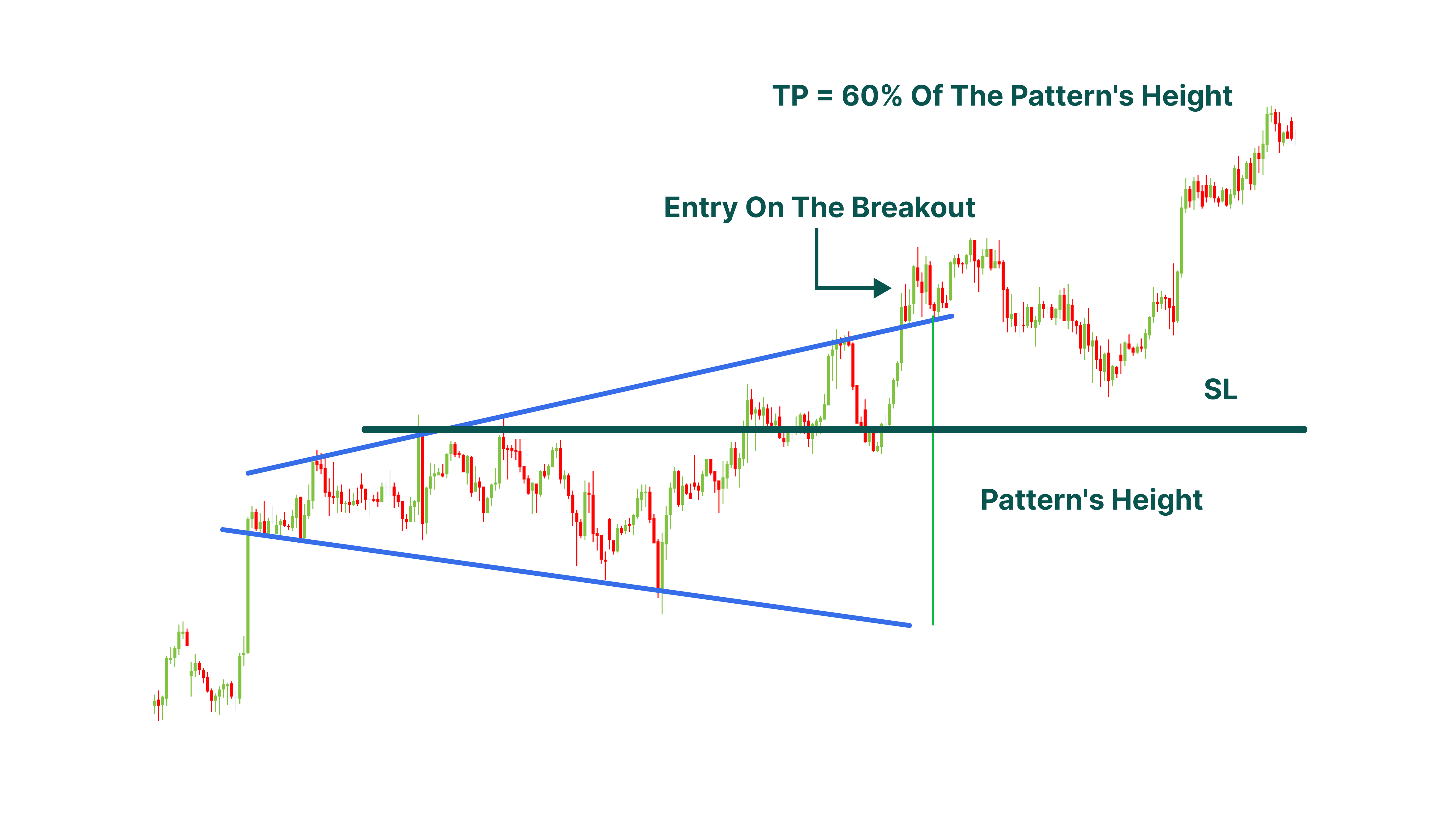

The first way to trade a megaphone pattern is to trade breakouts. A breakout happens when the price breaks one of the trendlines and closes outside the pattern. Breakouts can be bullish or bearish, and traders take them as the confirmation of a pattern and the direction of the following trend.

Trading breakouts means waiting until the price closes outside the pattern, confirming the completion of the megaphone pattern, and entering a trade when the direction of the price movement is clear. Note that it’s better to wait a bit to see if the breakout fails before making a decision.

When it comes to the minimum target, the common strategy is to measure the distance between the highest high and lowest low of the pattern, draw a line of the same distance from the breakout point in the direction of the new trend, and then place the minimum target at 60% of the resulting line’s length.

As for the Stop Loss, the general rule is to draw a line through the second Pivot Point High (for a bullish trend) or Pivot Point Low (for a bearish trend) and place a stop-loss order at this level.

Swing trades

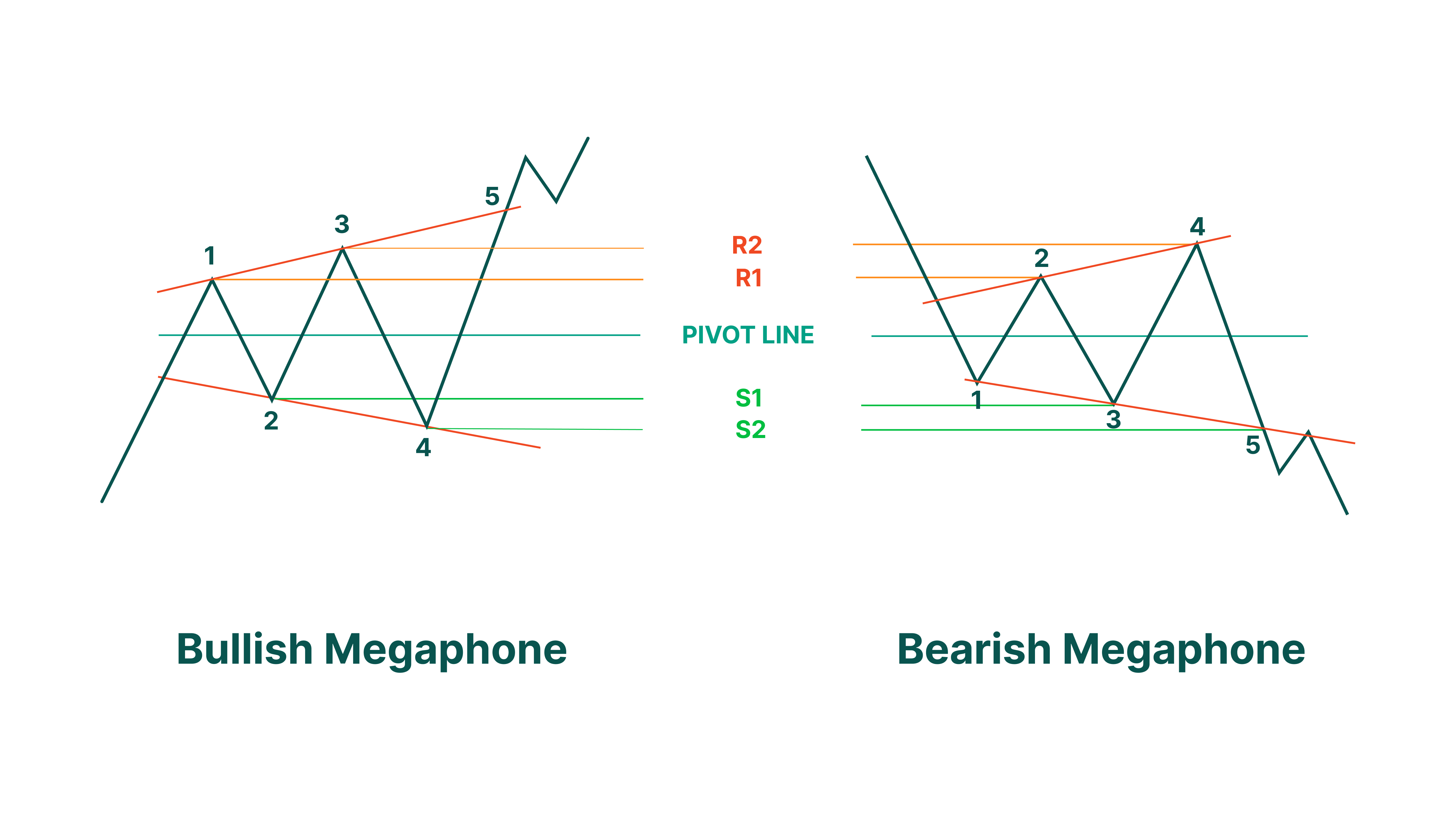

Since megaphone patterns consist of multiple swings, this is a good pattern to do swing trades. Swing traders capitalize on volatile markets, using the indecision of the majority of traders to their advantage. In case of megaphone patterns, swing traders can try and trade within the pattern, buying when the price hits a new lower low and selling when it marks a new higher high. This usually requires them to wait for the confirmation that the price hasn’t broken one of the trendlines.

But it’s also possible to trade on swings inside the pattern. All you need to do is to use the horizontal lines formed by the peaks and troughs of the pattern as well as the pivot line. Moreover, it’s also possible to use Fibonacci retracement levels to find potential support and resistance lines to trade right within the megaphone pattern.

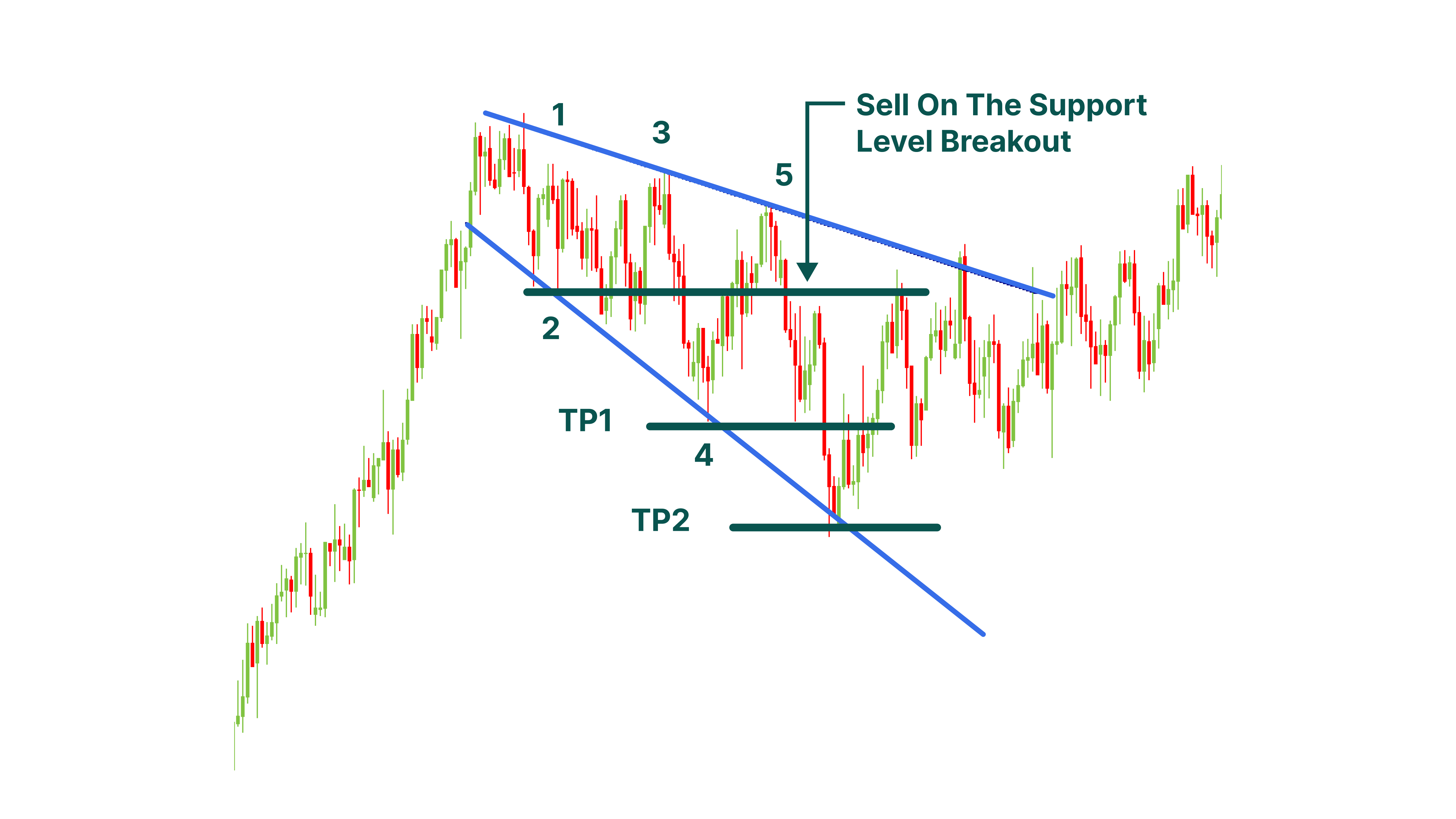

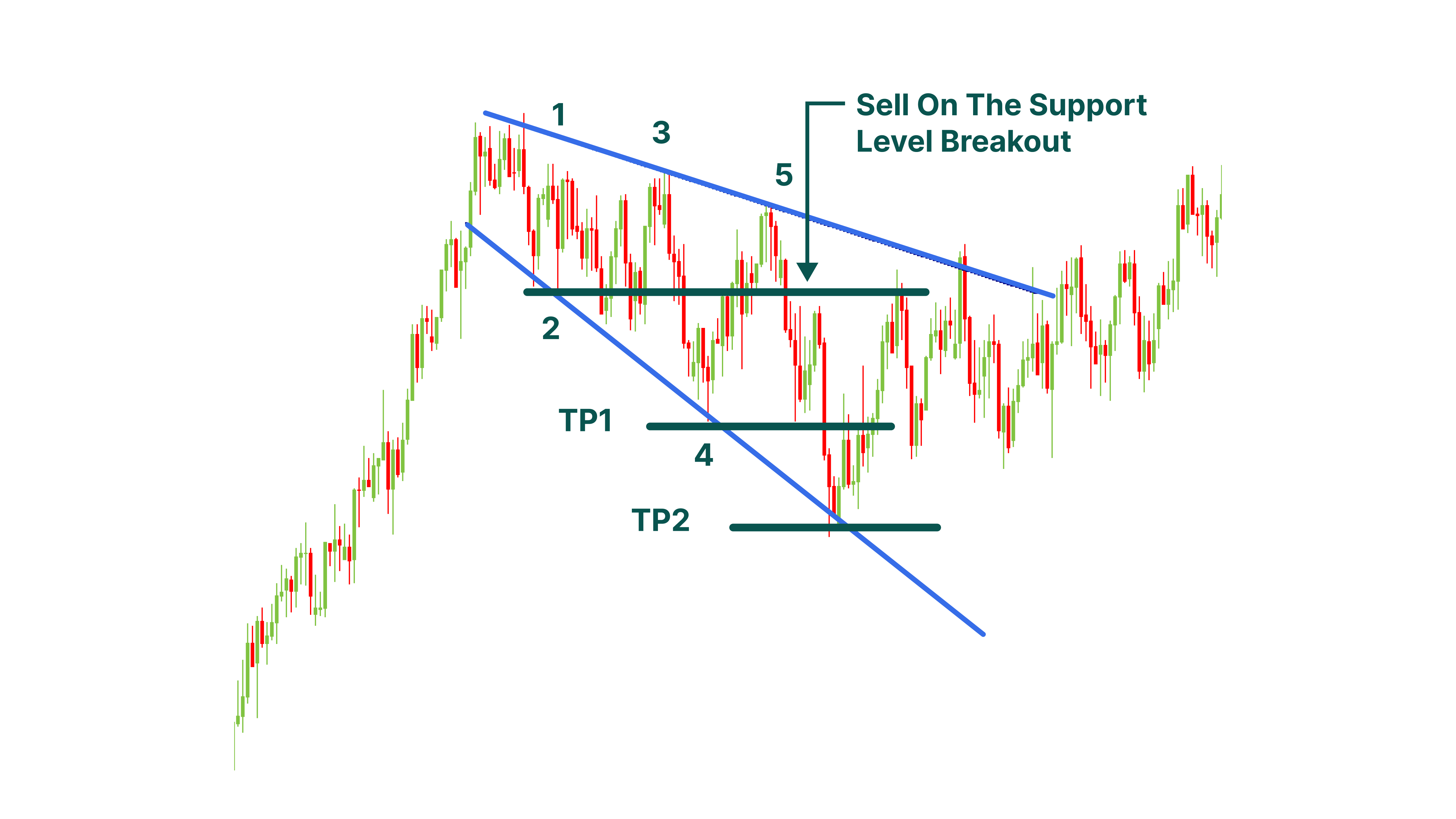

Failure

Like any other pattern, a megaphone chart pattern can fail to break out. Despite that, it’s still possible to trade it, though it’s important to identify the failure correctly. It’s actually quite easy because a megaphone pattern is considered a failure if the price doesn’t break one of the trendlines after the fifth swing. So if you see this pattern in a bull market, for example, and notice that the price bounces off a trendline after the fifth swing, you should consider going short when the price falls below the closest support level.

In this case, you can use levels formed by Pivot Point 4 as your first trading target and put the second potential target at the lower trendline of the pattern. As for the stop-loss order, you can put one at the level where the price failed to break out of the pattern after the fifth swing. You can also apply the risk/reward ratio in accordance with your own trading strategy.

Bottom line

In this article we learned about a megaphone chart pattern. A megaphone chart pattern occurs when the market is going through a volatile period and traders can’t decide on what the actual price of the asset in question should be.

Megaphone patterns can be bullish and bearish, but it’s hard to predict the direction of price movement and find the best entry and exit points without using additional indicators and technical analysis tools.